Kentucky Tax Calculator

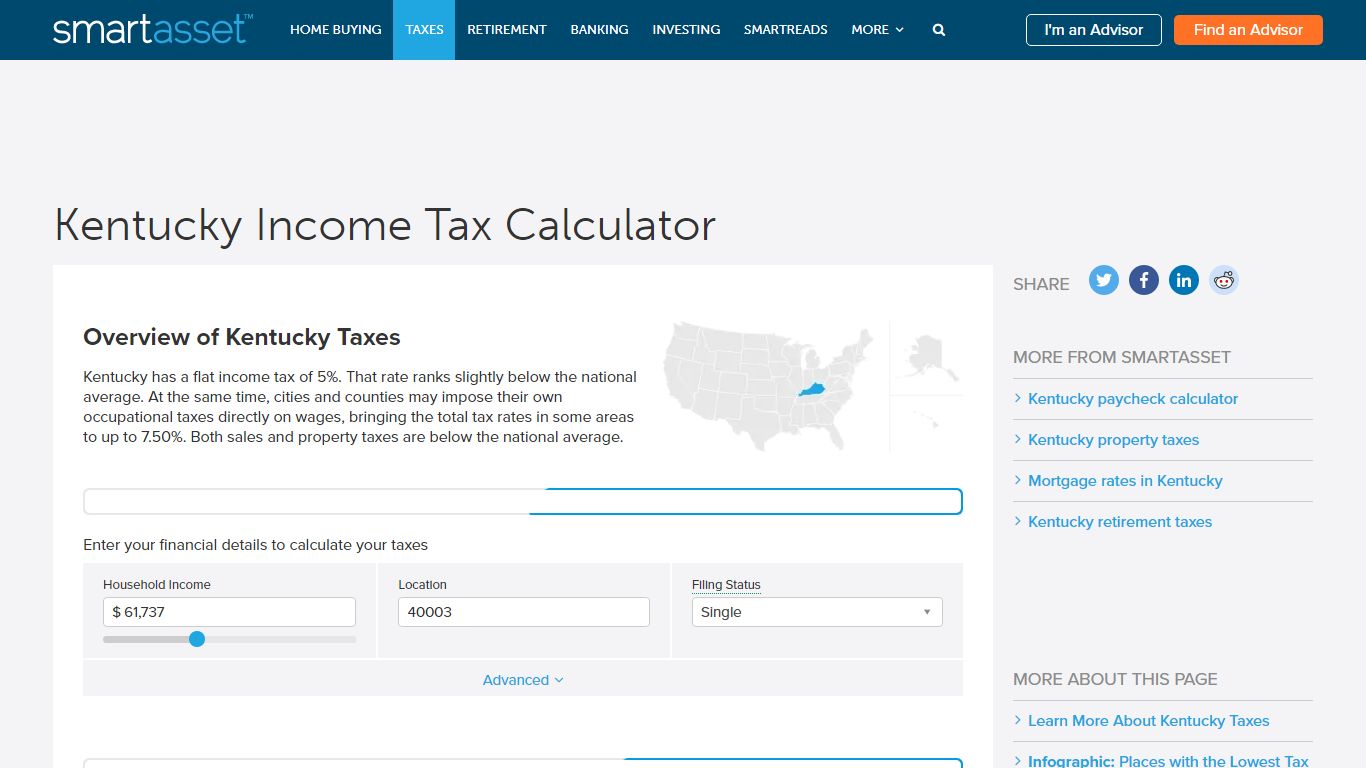

Kentucky Income Tax Calculator - SmartAsset

Kentucky has a flat income tax rate of 5%, a statewide sales tax of 6% and property taxes that average $1,257 annually. Both the sales and property taxes are below the national averages, while the state income tax is right around the U.S. mark. There are two unique aspects of Kentucky’s tax system.

https://smartasset.com/taxes/kentucky-tax-calculator

Kentucky Tax Calculator: Estimate Your Taxes - Forbes Advisor

Kentucky Income Tax Calculator 2021 If you make $70,000 a year living in the region of Kentucky, USA, you will be taxed $11,753. Your average tax rate is 11.98% and your marginal tax rate is 22%....

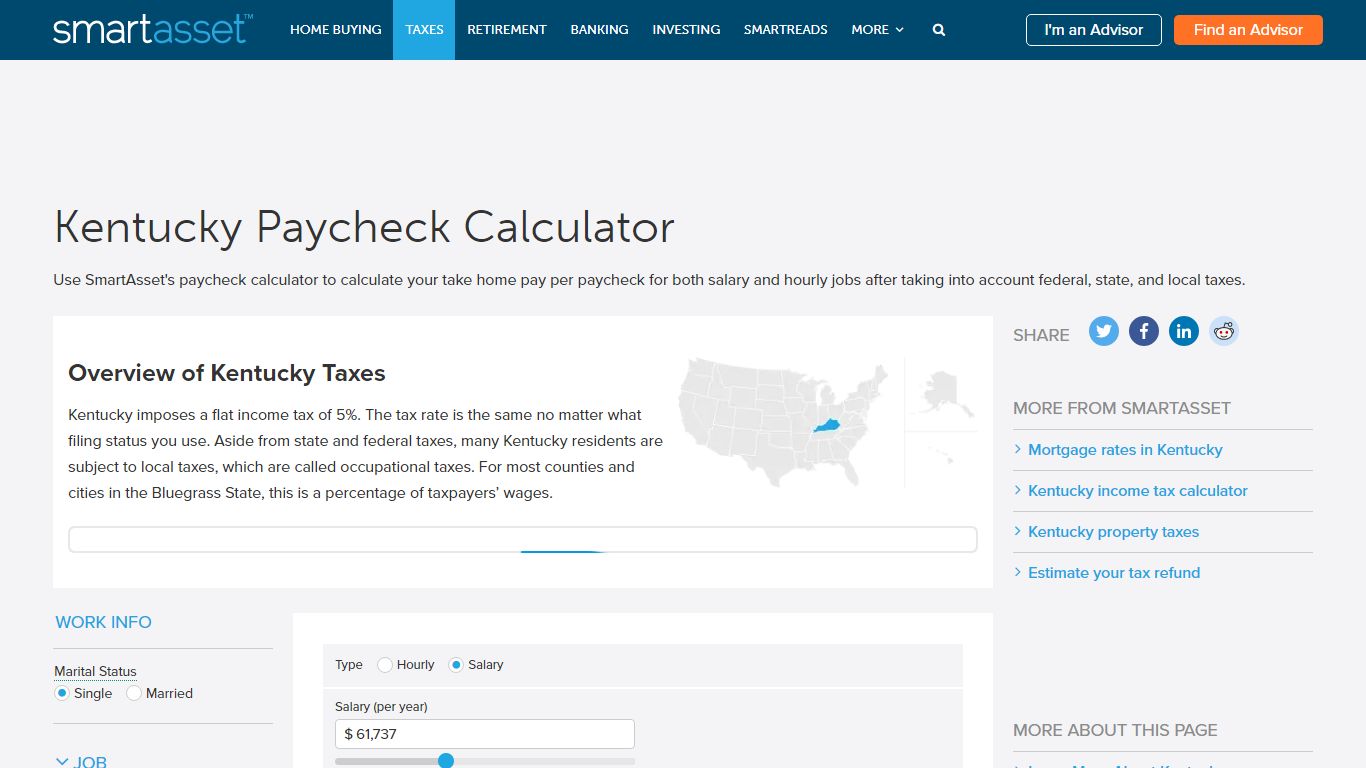

https://www.forbes.com/advisor/income-tax-calculator/kentucky/Kentucky Paycheck Calculator - SmartAsset

Use SmartAsset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. Overview of Kentucky Taxes Kentucky imposes a flat income tax of 5%.

https://smartasset.com/taxes/kentucky-paycheck-calculator

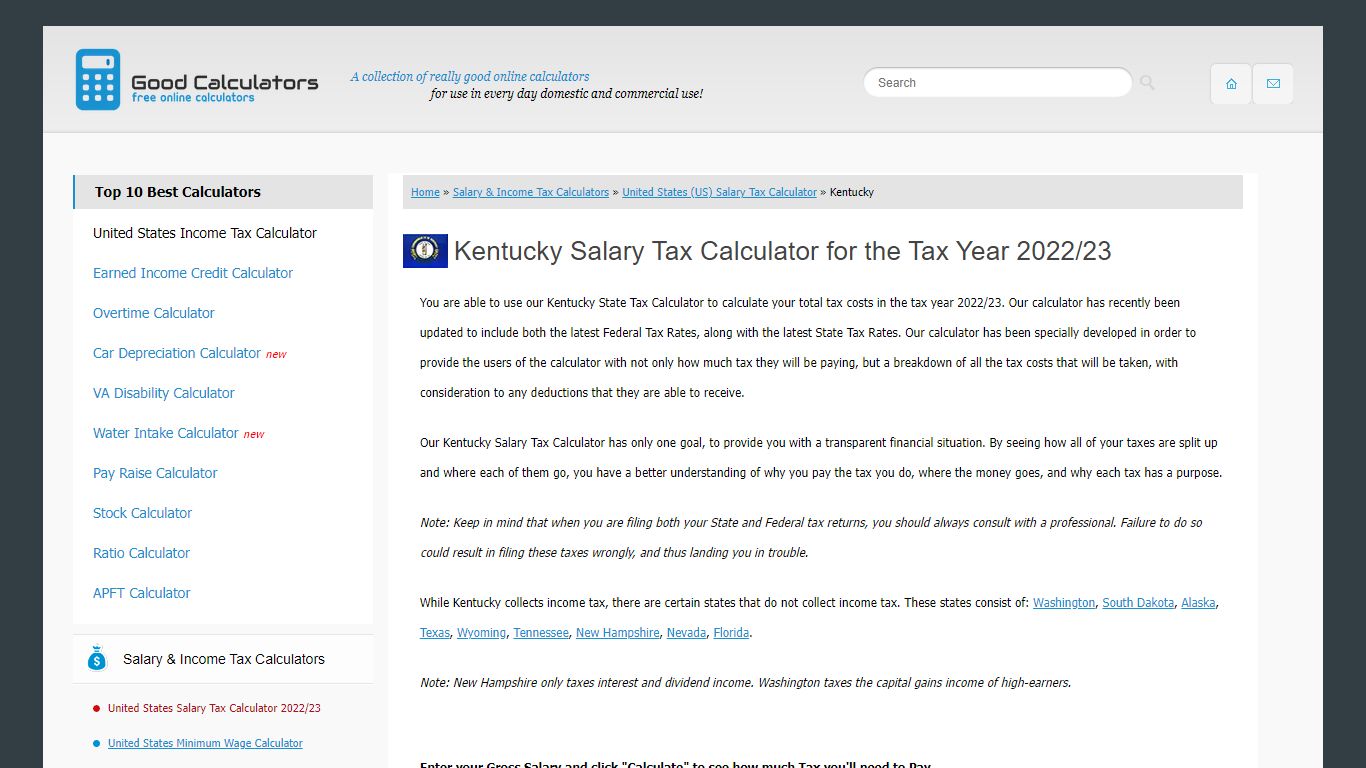

Kentucky State Tax Calculator - Good Calculators

To use our Kentucky Salary Tax Calculator, all you have to do is enter the necessary details and click on the "Calculate" button. After a few seconds, you will be provided with a full breakdown of the tax you are paying. This breakdown will include how much income tax you are paying, state taxes, federal taxes, and many other costs.

https://goodcalculators.com/us-salary-tax-calculator/kentucky/

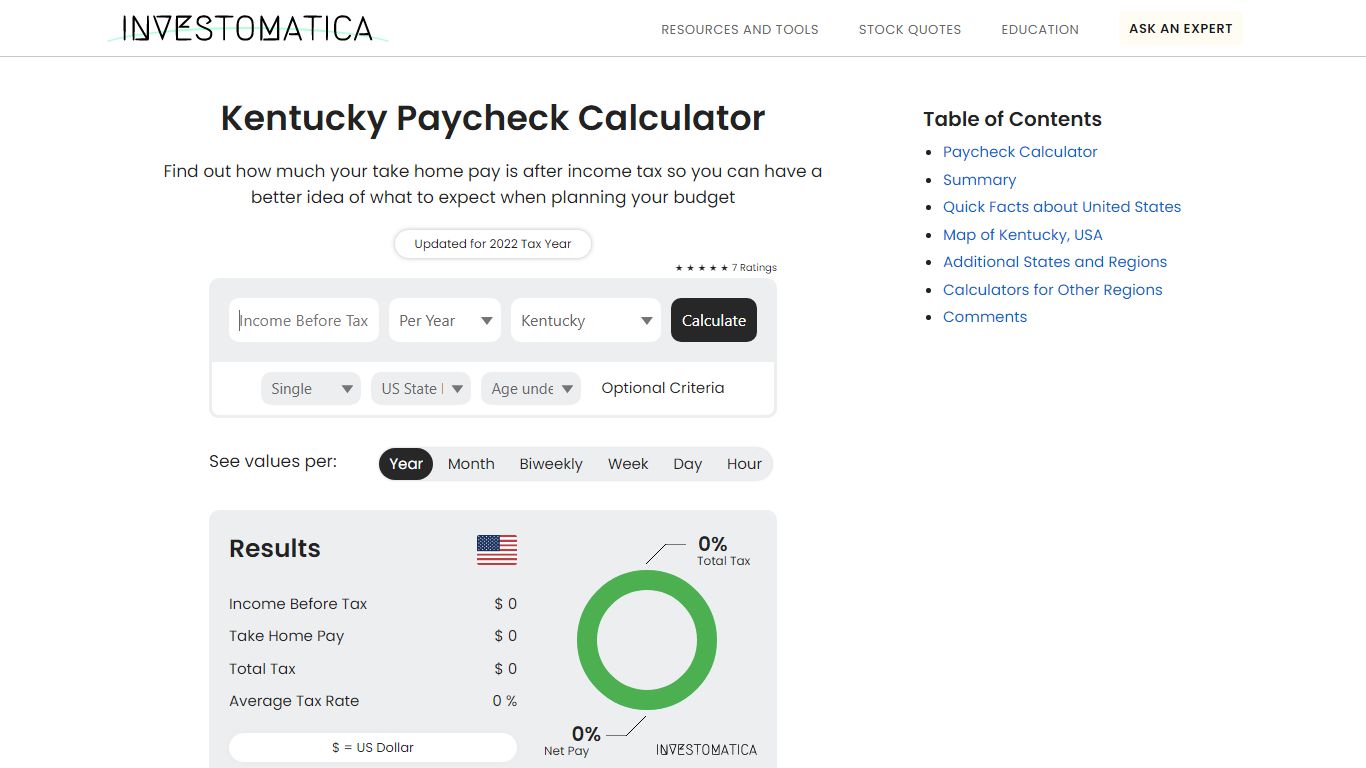

Kentucky Income Tax Calculator - Investomatica

The state income tax rate in Kentucky is 5% while federal income tax rates range from 10% to 37% depending on your income. This income tax calculator can help estimate your average income tax rate and your salary after tax. How many income tax brackets are there in Kentucky? The state income tax system in Kentucky only has a single tax bracket.

https://investomatica.com/income-tax-calculator/united-states/kentucky

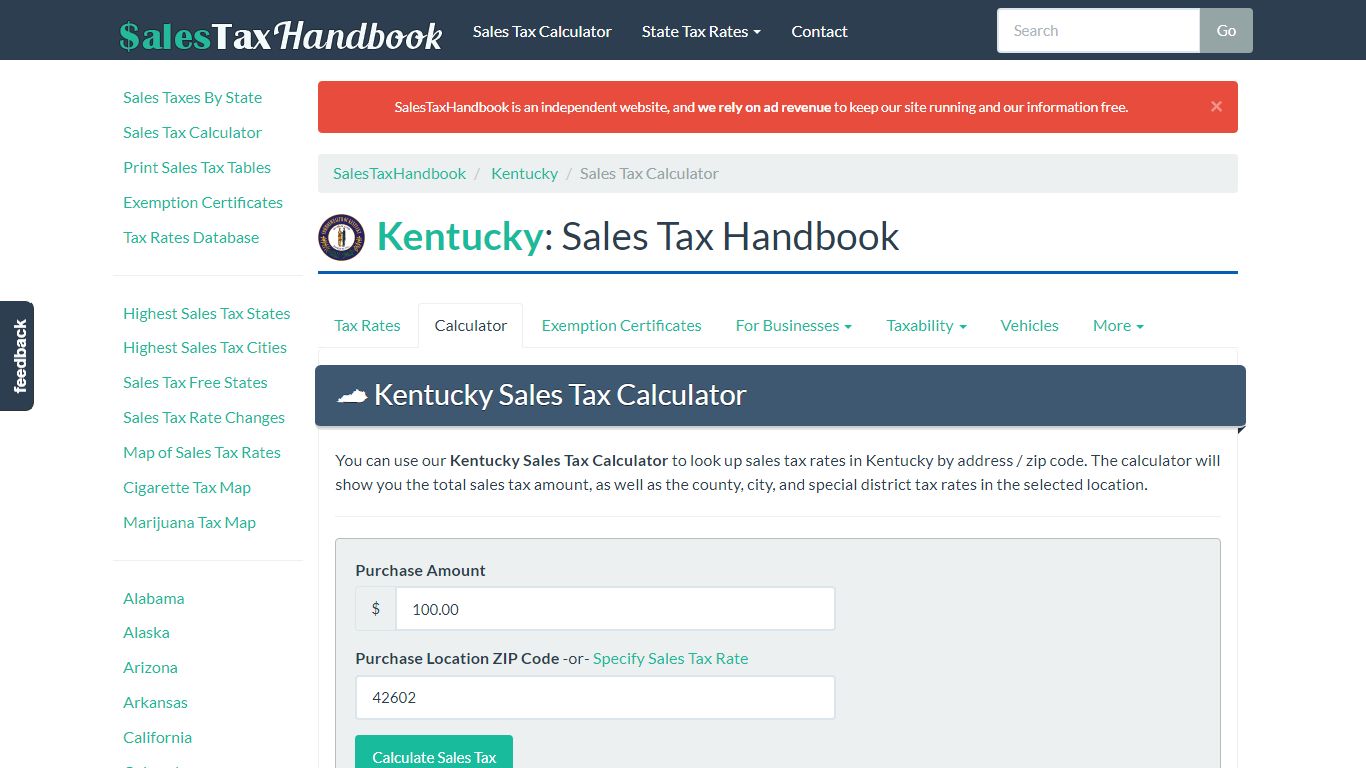

Kentucky Sales Tax Calculator - SalesTaxHandbook

Kentucky Sales Tax Calculator You can use our Kentucky Sales Tax Calculator to look up sales tax rates in Kentucky by address / zip code. The calculator will show you the total sales tax amount, as well as the county, city, and special district tax rates in the selected location. Purchase Location ZIP Code -or- Specify Sales Tax Rate

https://www.salestaxhandbook.com/kentucky/calculator

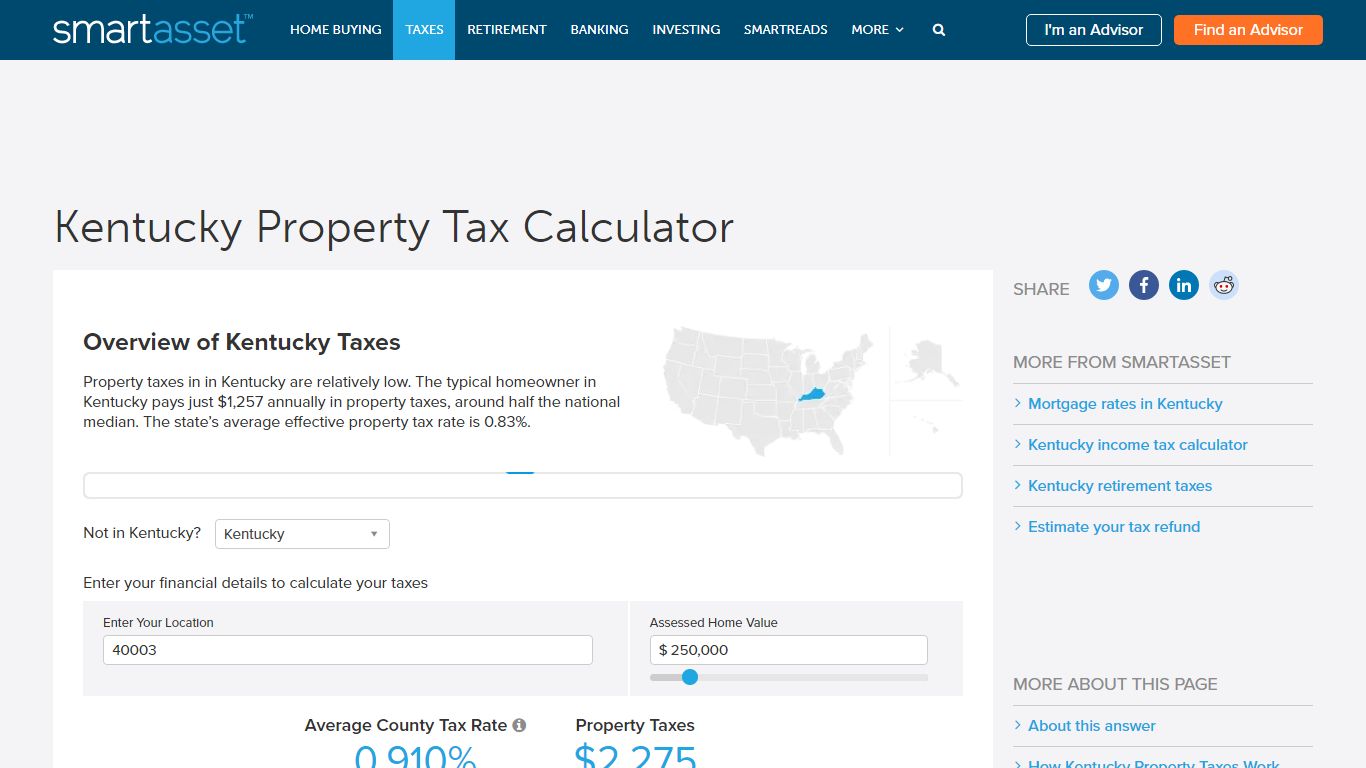

Kentucky Property Tax Calculator - SmartAsset

Tax rates are calculated during the summer and tax bills are sent out in the fall, typically by either Oct. 1 or Nov. 1. In areas where bills are sent out by Oct. 1, homeowners who pay their bill by Nov. 30 receive a 2% discount on the total amount. Conversely, homeowners who do not pay until January face a 5% penalty.

https://smartasset.com/taxes/kentucky-property-tax-calculator

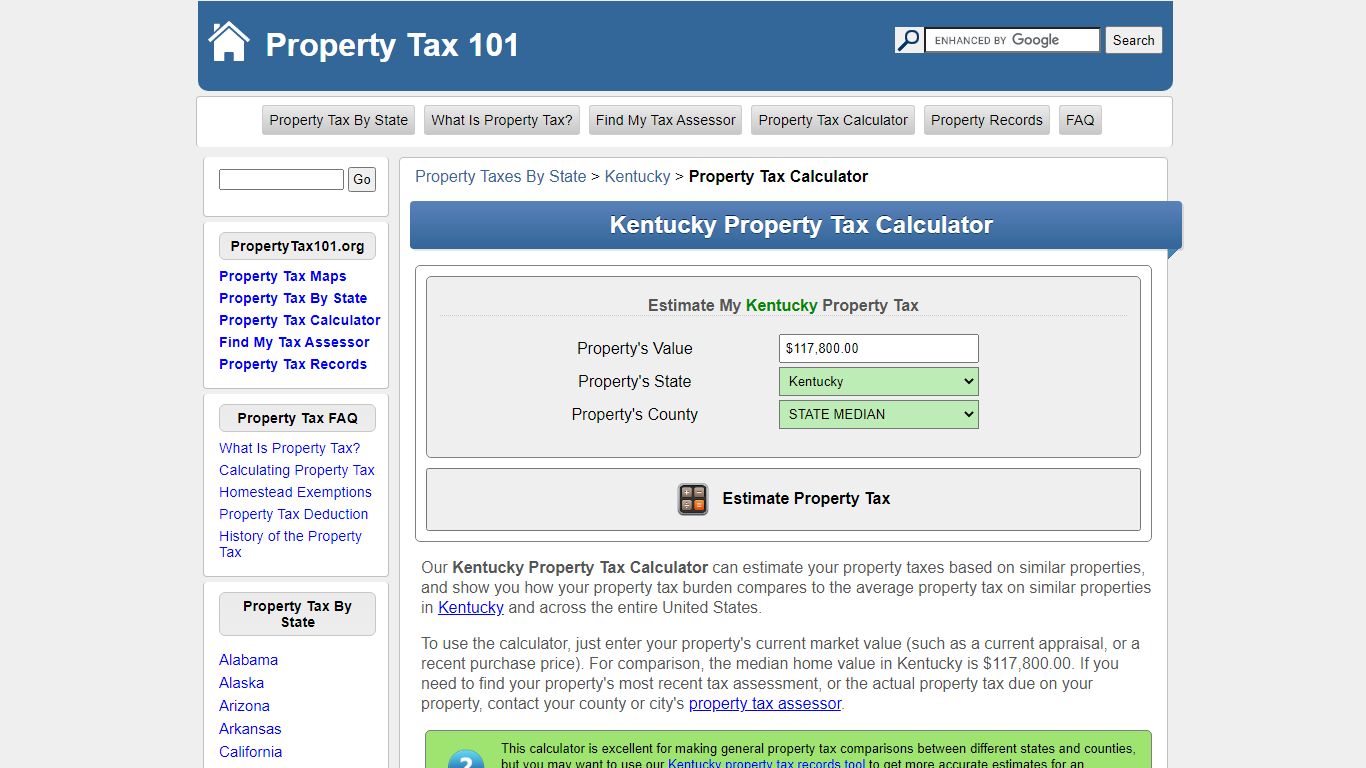

Kentucky Property Tax Calculator

This calculator is excellent for making general property tax comparisons between different states and counties, but you may want to use our Kentucky property tax records tool to get more accurate estimates for an individual property. In many cases, we can compute a more personalized property tax estimate based on your property's actual assessment valuations.

https://www.propertytax101.org/kentucky/taxcalculator

Individual Income Tax - Department of Revenue - Kentucky

If your pension income is greater than $31,110, you will need to complete Kentucky Schedule P, Kentucky Pension Income Exclusion to determine how much of your pension income is taxable. You may use the worksheet in the Schedule P instructions or you may use the Schedule P calculator to determine your exempt percentage.

https://revenue.ky.gov/Individual/Individual-Income-Tax/Pages/default.aspx

Kentucky Paycheck Calculator | ADP

Use ADP’s Kentucky Paycheck Calculator to estimate net or “take home” pay for either hourly or salaried employees. Just enter the wages, tax withholdings and other information required below and our tool will take care of the rest.

https://www.adp.com/resources/tools/calculators/states/kentucky-salary-paycheck-calculator.aspx

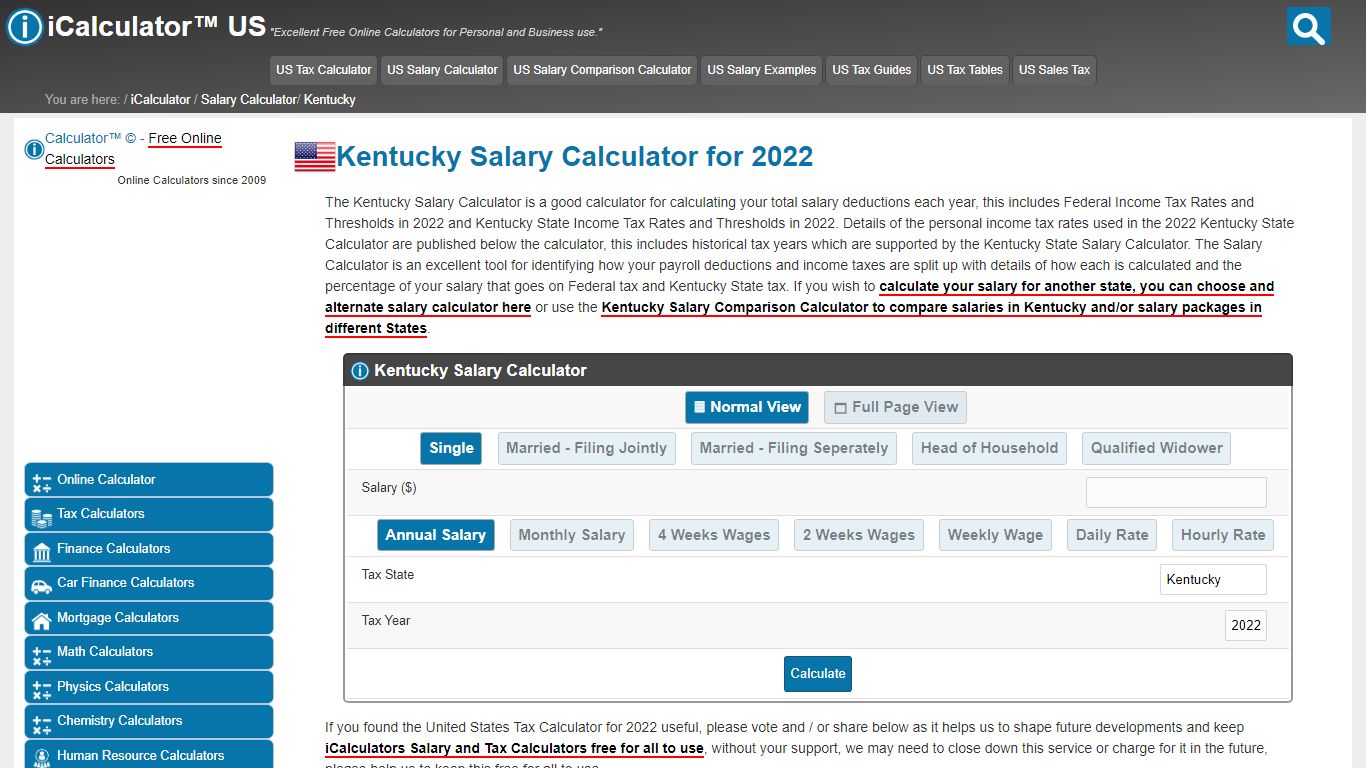

Kentucky Salary Calculator 2022 | iCalculator™

The Kentucky Salary Calculator is a good calculator for calculating your total salary deductions each year, this includes Federal Income Tax Rates and Thresholds in 2022 and Kentucky State Income Tax Rates and Thresholds in 2022. Details of the personal income tax rates used in the 2022 Kentucky State Calculator are published below the calculator, ...

https://us.icalculator.info/salary-calculator/kentucky.html